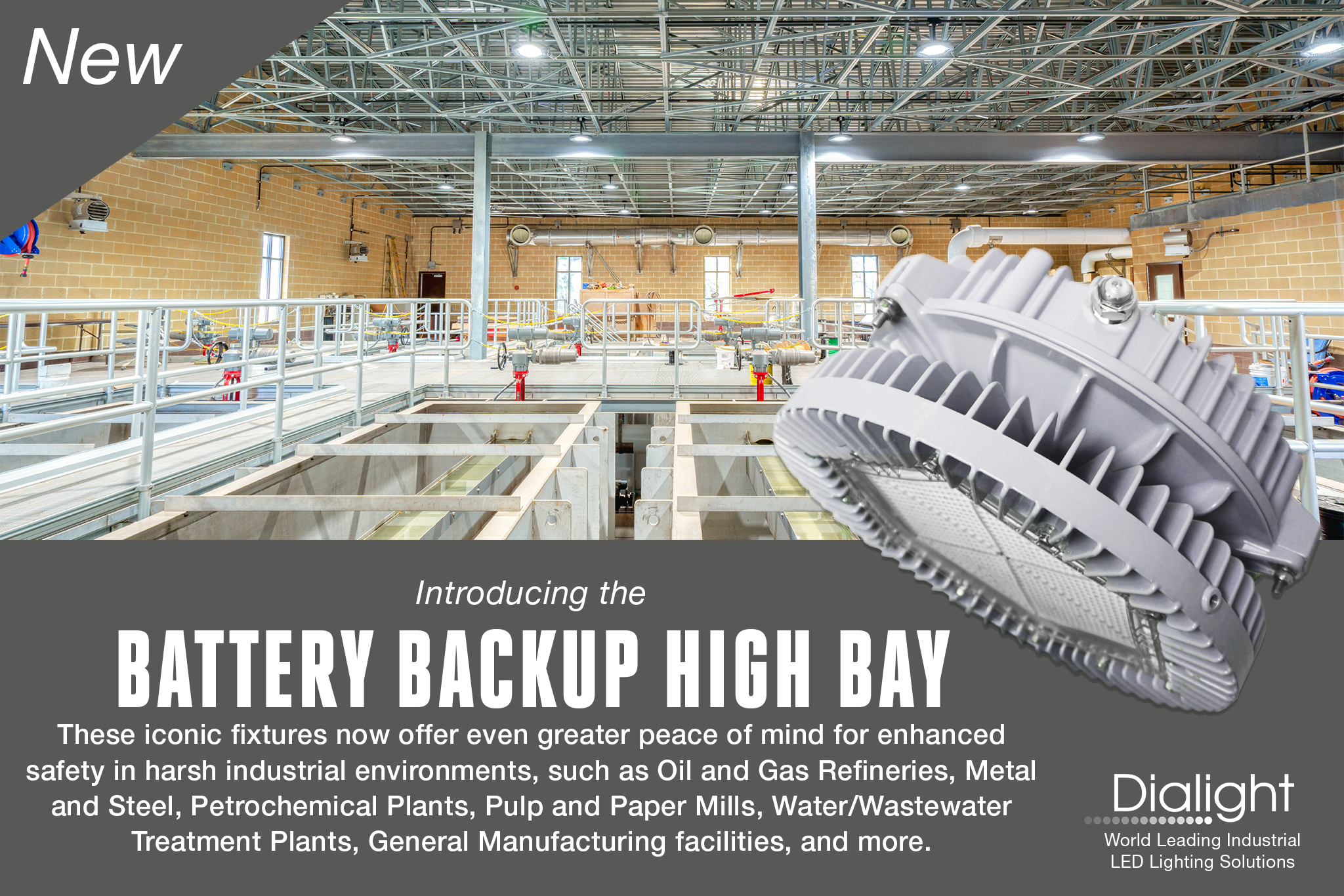

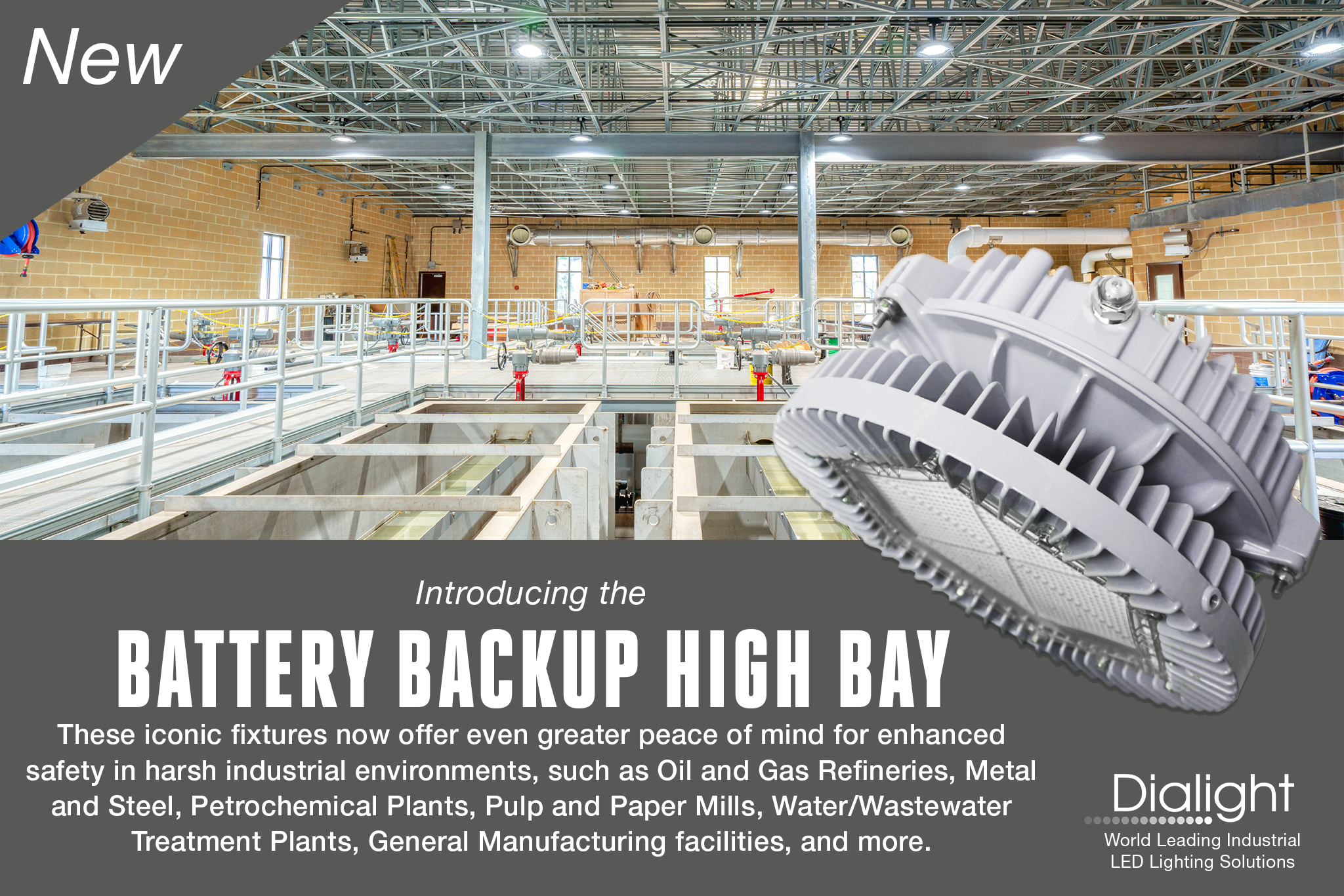

Dialight LED Lighting News & Events

Find all of the latest Dialight LED lighting news and information regarding events Dialight is attending here.

Events

News

Find all of the latest Dialight LED lighting news and information regarding events Dialight is attending here.